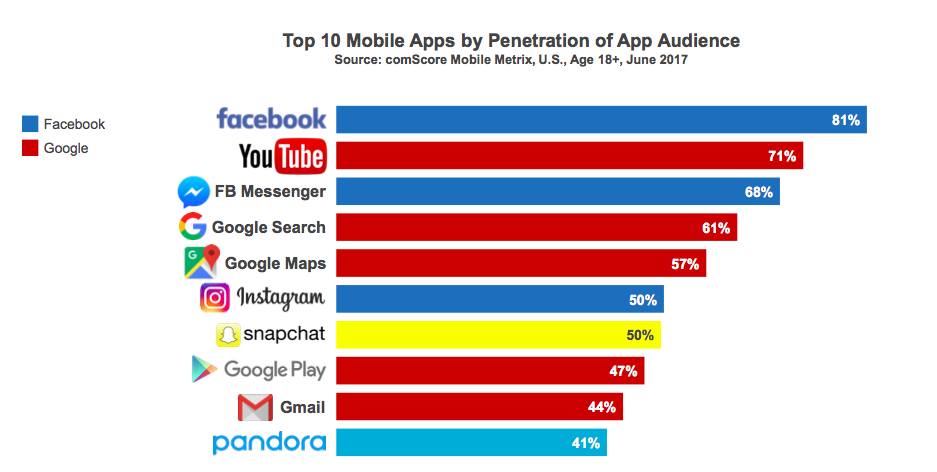

Google, Apple, Facebook and Amazon (GAFA) are now the most valuable and successful companies in the world. This also means that they’re maturing rapidly and this means the platforms they ride on are mature quickly as well. These companies are carrying boatloads of money which give them the power of money to compete against any new (potential) threat quickly. A good example is Google Home and the subsequent push by Google to bring this product to as many consumers as fast possible. It is competing against the highly successful Amazon Echo family of products.

Another example is the introduction of “snapchat” features into the different properties of Facebook. Instagram and WhatsApp reached 200M DAUs within months – just compare that to Snapchat’s 160M DAUs on IPO which took them years to get to that point.

So strictly speaking any new development on the internet or mobile will either be quickly bought up or copied by these companies. And this will make it much harder to launch and grow a successful competing company on these platforms.

History also tells us that when companies reach this height and as their platforms further mature, new platforms and opportunities will arise. And interesting enough these companies will not be able to compete or turn around their business to take full advantage of this. This might sound inconceivable today, but let’s look at these two examples.

First, there’s Walmart, the biggest retailer in the world, but in online retail they’re irrelevant. You’d think that a company with the resources and knowledge of retail would be able to compete and keep up with online retail competitors. But they are not. Of course, they won’t go away, but they will not become the number one online retailer anymore.

The same can be said about Microsoft. They completely missed the boat on the internet and mobile platforms until it was too late. You could even argue they missed the cloud platform as well. Same applies to Intel. Intel missed the boat on mobile as well. Together they were known as Wintel and they were the jewels of the nineties. Now, these companies have become irrelevant from a mindshare and technology direction perspective.

Before Wintel, there was IBM. IBM was the computing company of the 80s, but today they’re irrelevant.

Of course IBM, Microsoft, Intel and Walmart are still alive and generating sizable revenues. Irrelevancy does not mean bankruptcy – in many ways, these companies are too big to fail. But they’re on the infinite road of playing catch up in their respective markets.

This brings me to my point that the hegemony of GAFA will go away as well. You already see some early signs of this in both Google and Apple. Google spends an extraordinary amount of money ($15B in 2016) on R&D but no new platform has emerged from it yet. Same applies to Apple. Their biggest product launches in the last 5 years were just accessories – watch and AirPods – and not platforms. They’ll never be able to grow into revenue streams similar to iPhone or Macbooks.

Taken together, you could come to the conclusion that we’re on the brink of a new major platform to emerge. Investment dollars and ideas are turning away from more traditional investments in internet services and mobile towards other platforms. At this point, it is impossible to say what these new platforms will be. It is pretty certain that they will emerge from all the attention towards blockchains, machine learning/AI and augmented reality/virtual reality. None of these technologies is a platform but you can bet on it that it will be enabled by one or more of them.

Platforms emerge when there is a technology breakthrough which makes it possible to bring technology to form factors or places which were previously impossible.

Electric autonomous vehicles are way on top of my list. It will be as disruptive as the internet. Cities will change; no need for parking lots, people can live further out in suburbia. Car-ownership will change, there might not even be a need to own a car anymore. This will impact car dealerships and car manufacturers. We might only end up with a few of manufacturers and reach complete commoditization of car manufacturing. There will be no further need of gas stations. Cars are probably maintained by large corporations running major fleets of autonomous vehicles. The car wash will go away. There is no longer need for the DMV and maybe policing of traffic is a thing of the past. Tax revenue streams need to be readjusted.

A little further out but as fundamental as the computer processor or the internet, I would bet on either power consumption or power storage technology. The biggest problem holding back many potential applications, form factors, and new technology is power consumption and power storage. Any new technology which can decrease power consumption or increase power storage densities by 100x is going to change the world fundamentally.

It is not limited to power consumption or power storage. The new technology can also change the paradigm on how devices work. For instance, power could be transmitted wirelessly. Or the technology can offer a way to offload 99% of processing to a different device while offering a full-fledged platform performance.

When that happens it is pretty obvious what is going to happen. History is telling us that again. Typically an emergence of a new technology is unbundling existing platforms and then bundles it again into the new platform. For instance, the internet unbundled many things like the cable subscription, magazine subscriptions, music distribution, phone subscriptions and this is still going on. Currently, a lot of offerings of the banking industry is being unbundled like debit cards, loans, mortgages, and insurance. But at the same time, you see new bundles appear. GAFA is a good example of this. They bundle and protect their own platforms. The openness of the web has been replaced with proprietary – and much less open – platforms like IOS and Android. The mobile phone bundles everything like your wallet, camera and must player. Facebook is pulling everyone into their walled garden much like AOL did at the time with their own version of the web.

And this is my second major observation for the next platform which is openness. All the major platform shifts were twofold. First, the emergence of new technology which allowed new form factors, services or applications not previously possible before. And second, the emergence of an open standard to make us of the new platform. It is essential to level the playing field for a new technology to become successful. For instance, if the new technology would be of the nature of wireless power transmission, it would only start to take off when the platform or protocol is open.

When this all happens the whole cycle will start over again.